DISGREGATION FOR DONATIONS TO ALMA

EVERYTHING YOU NEED TO KNOW ABOUT HOW TO DRAW YOUR DONATIONS

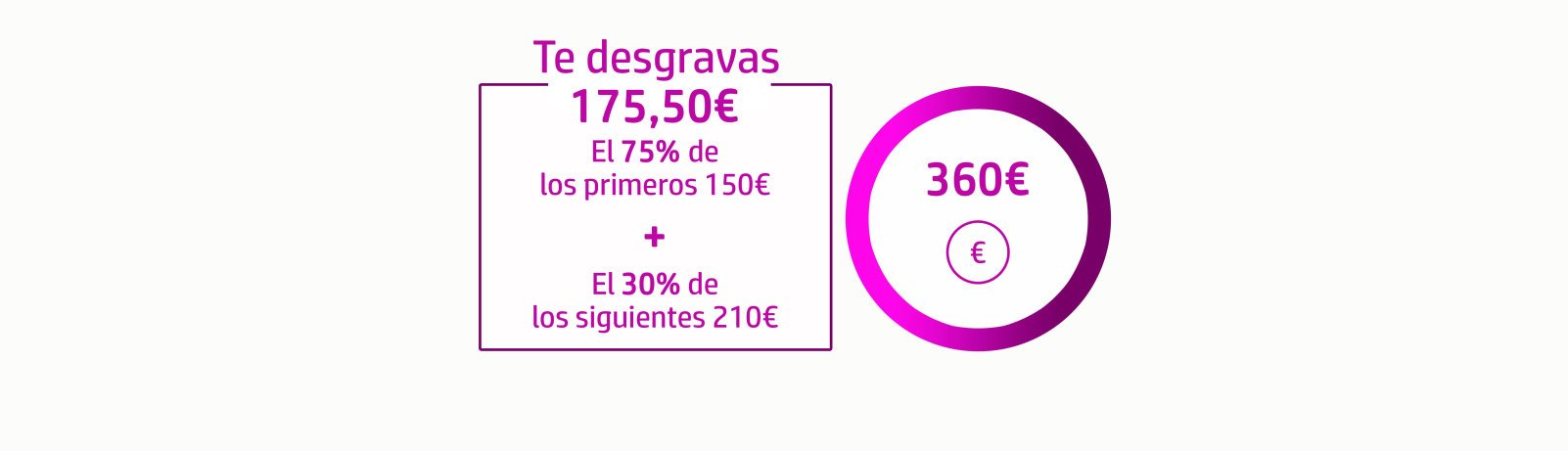

HOW MUCH DO THEY DONATE YOUR DONATIONS?

75%

Until the first

€ 150

30%

Of the amount from€ 150

In addition, if you have been with us for 3 years or more, from 30% you pass to 35% of the amount from 150 €. In this example you would deduct a total of € 186

How to deduct your donations to ALMA in three steps?

of the ALMA Association

At the beginning of the year we will send you a Certificate of donations to your home

Include it in your Income Tax return and you will recover up to 75% of your aid

If you are a company, you can also degrave your donations to ALMA

If you are a company you deduct the 35% if you have been less than three years

collaborating with ALMA and a 40% if you have been 3 years or older.

- In addition, if you reside in an Autonomous Community that is subject to a specific regional regime or with additional deductions for donations to NGOs, you can have different deductions.

- Do not forget to indicate your ID or NIF when filling out the form so that our entity can inform the Tax Agency in January.